What is perodua total protect plus?

Convenient

Showrooms nationwide

Hassle-free

Peace of mind

Why Choose Perodua?

Plus Benefits

Unlimited Unnamed Drivers

Flood Allowance of RM1,000

Personal Accident Insurance (PA) of RM10,000*

RELIABLE PROTECTION

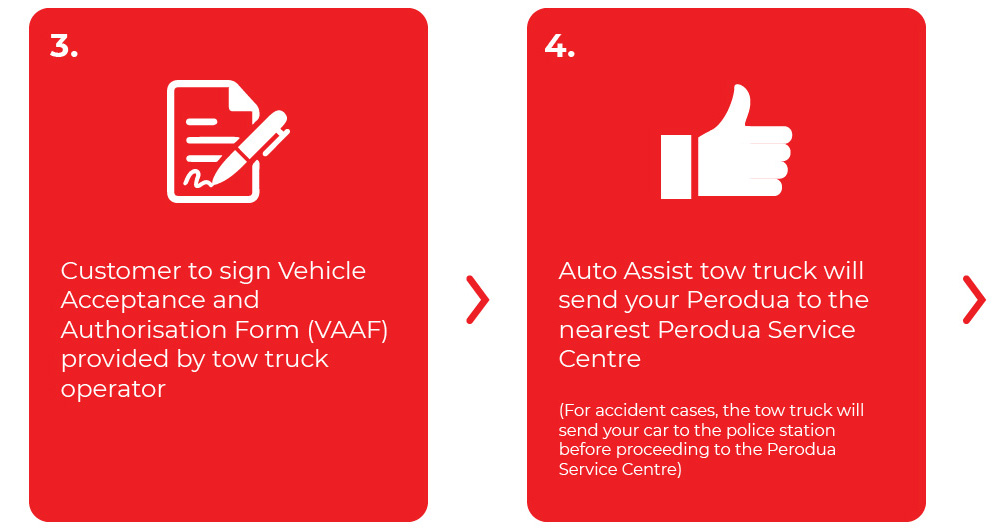

Easy steps for

perodua total protect plus

Call or visit any Perodua Showroom nationwide.

Ask for Motor Insurance plan/renewal quotation and additional coverage information (only valid with Perodua Insurance partners).

Get covered by Perodua Total Protect Plus.

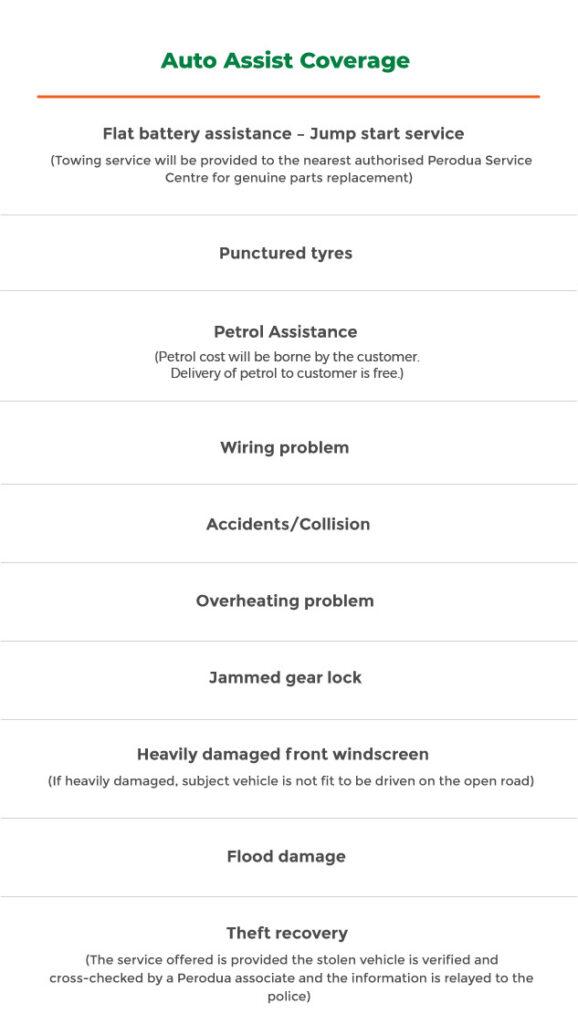

Auto assist coverage

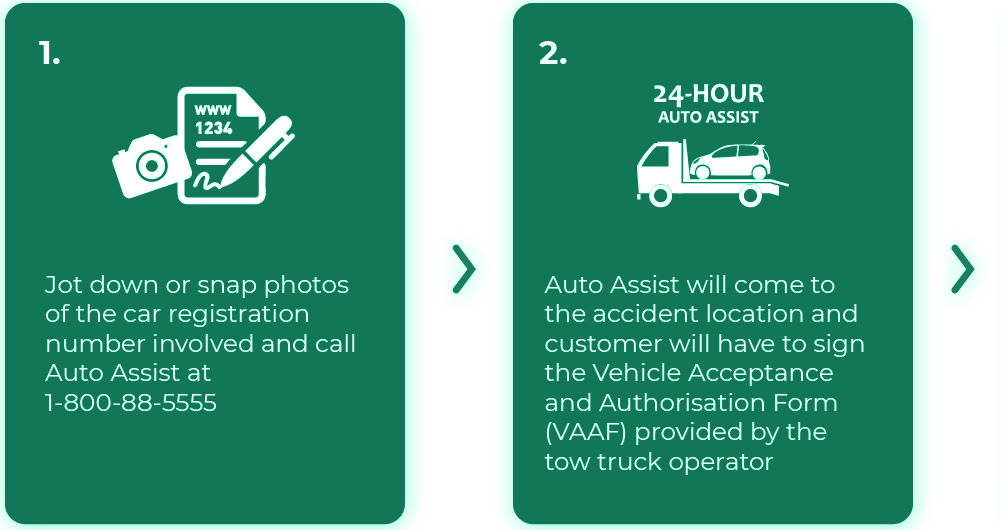

Call Auto Assist Toll Free at 1-800-88-5555 for breakdown and accident assistance.

Membership

Auto Assist Benefits

24-Hour Nationwide Accident and Breakdown

1. Free Breakdown towing up to 300km or RM600

2. Accident towing up to RM300

This service is available 24 hours a day, 7 days a week.

Any cost incurred for toll charges shall be borne by the member.

24-Hour Call Centre Service

In the event of a breakdown or accident, call the Auto Assist toll-free number at 1-800-88-5555.

Roadside Assistance

(e.g. jump start and changing flat tyre services)

(e.g. jump start and changing flat tyre services)

Our rescue team will assist members for minor problems. Should towing be required, the vehicle will be towed to the nearest authorised Perodua Service Centre.

Free Towing Services to the nearest authorised Perodua Service Centre.

Auto Assist shall provide free towing to the nearest authorised Perodua Service Centre as follows:

All gazetted roads on Peninsular Malaysia;

Within 300 km (to and from base) of the following towns in East Malaysia:

Kuching, Serian, Sri Aman, Sibu, Mukah, Miri, Limbang, Bintulu.

Kota Kinabalu, Sandakan, Lahad Datu, Tawau, Semporna, Federal Territory of Labuan.

Non-gazetted and estate roads and islands of Malaysia, except Pulau Pinang and Pulau Langkawi

Emergency Evacuation Services*

Alternative Transport Assistance with E-Hailing

The Auto Assist team shall provide free transportation to members that are heading the same way while attending to or returning from the scene of the breakdown.

Should members require a taxi, the Auto Assist team will assist in calling for one. In the case of an e-hailing service, an *e-voucher shall be provided once a request is submitted through the Auto Assist team.

Car Rental Services

Free Hotel Accommodation*

If accident occurs out of state or 100 km from the member’s place of residence, the member is entitled to one (1) night free hotel accommodation, up to a limit of RM150 in the event where the member is unable to complete his/her journey.

Subject to the following conditions:

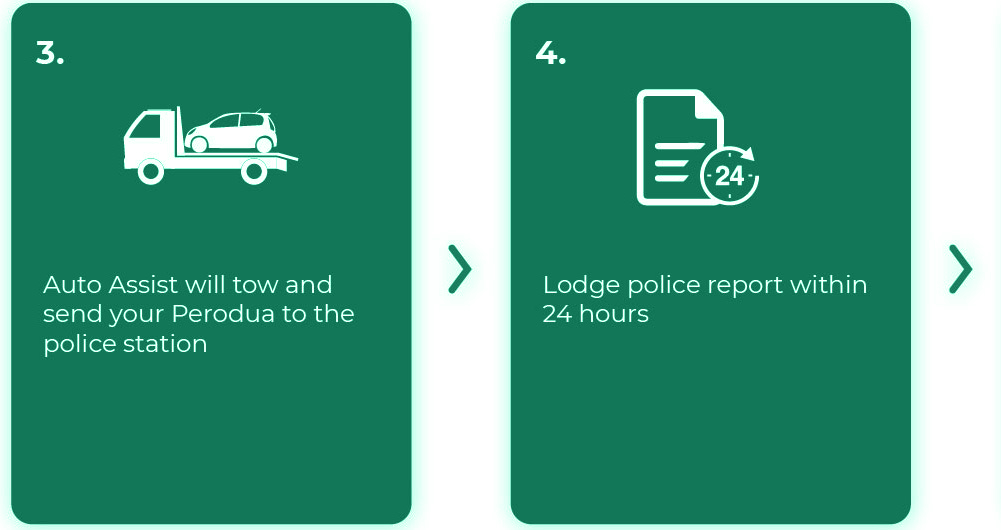

1. Vehicle is towed to an authorised Perodua Body Repair and Paint outlet

2. Repair of the car will take more than 48 hours

Documents required:

• Official Hotel Receipt

• Perodua Repair Order

• Police Report

• Photos

Loss of Personal Belongings from Car Break-In*

Non-Insurance Accident Repair*

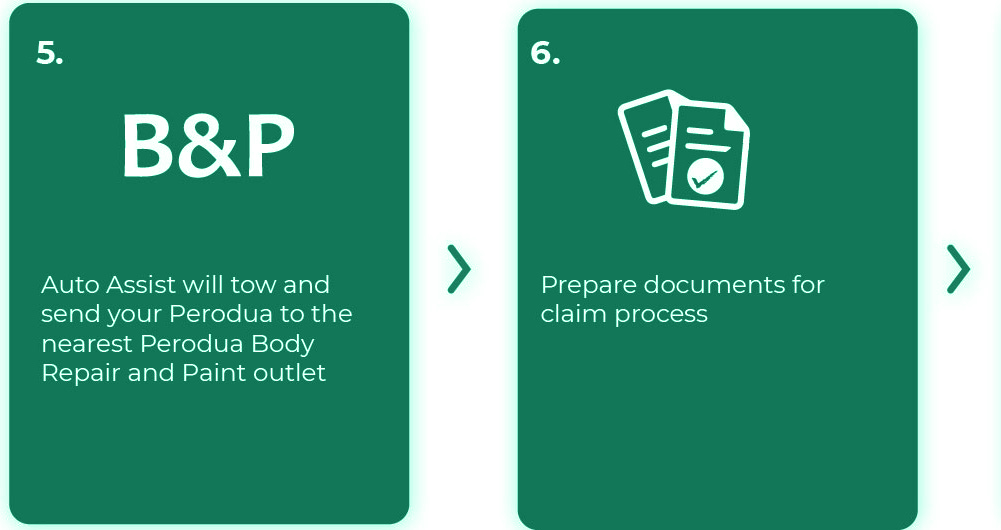

In the event of an accident, members shall be entitled to a free towing service up to a limit of RM200 to the nearest authorised Perodua Body Repair and Paint outlet, if the accident repairs are not subject to an insurance claim.

This is only applicable if the vehicle is repaired at an authorised Perodua Body Repair and Paint outlet.

Documents required:

• Police Report (accident)

• Insurance Cover Note (optional)

Car Stolen*

Basement towing

Baby Tyre or Go Jack

Overseas assistant (Singapore & Thailand)

Referral services in both countries for breakdown and accident must be repaired at local workshop.

REMINDERS:

*Terms and conditions apply.

In the event of an emergency, contact our 24-hour Perodua Auto Assist at

1-800-88-5555

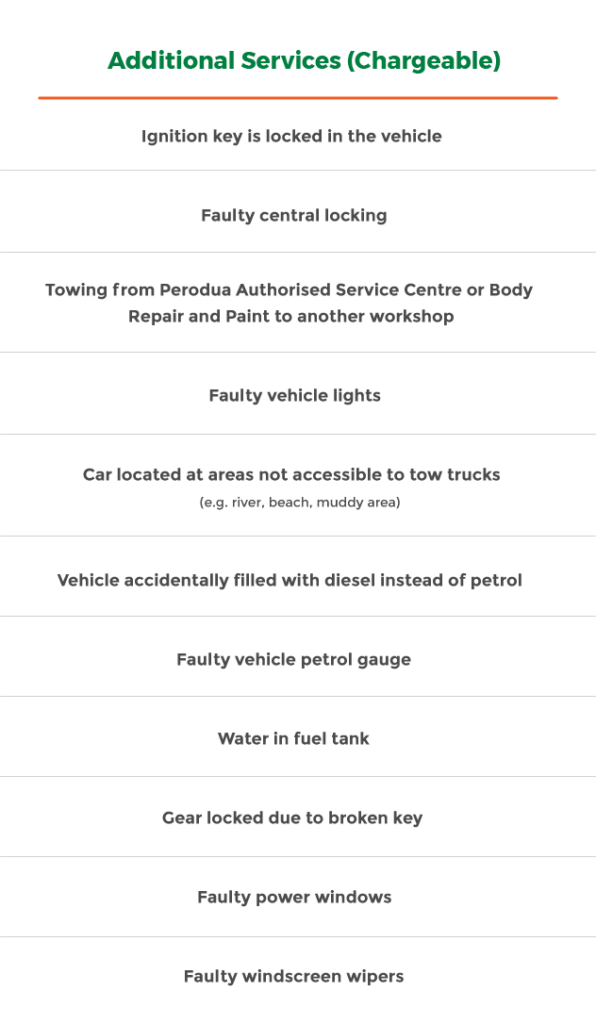

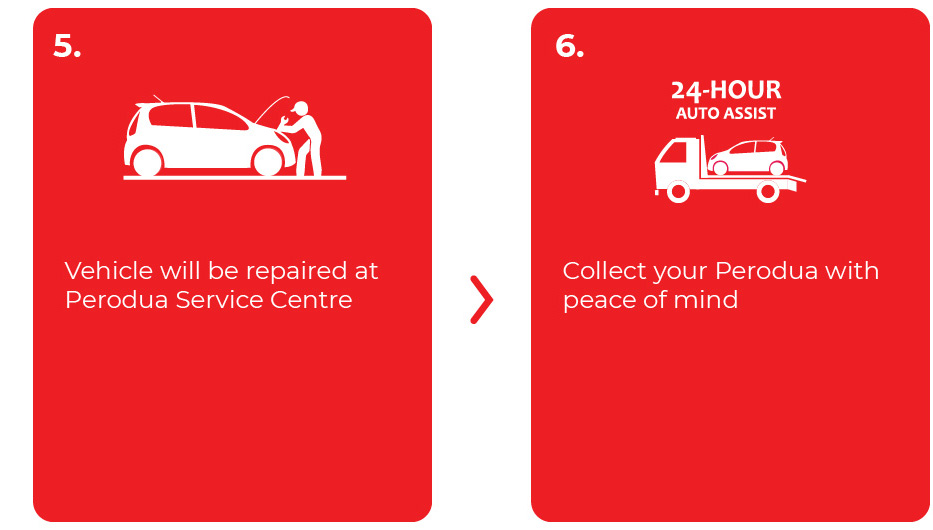

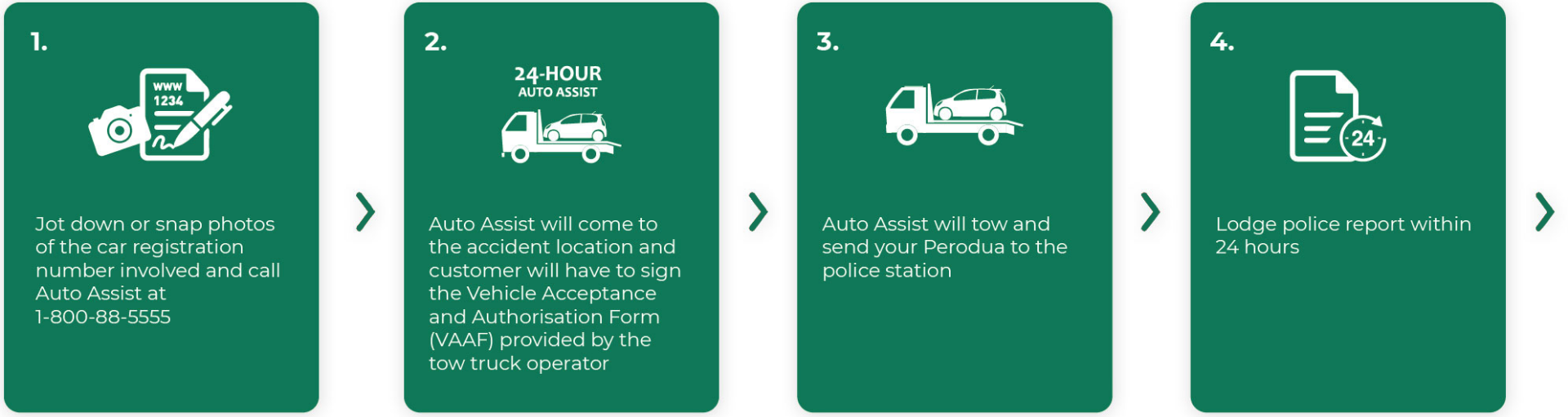

What to do in case of emergency?

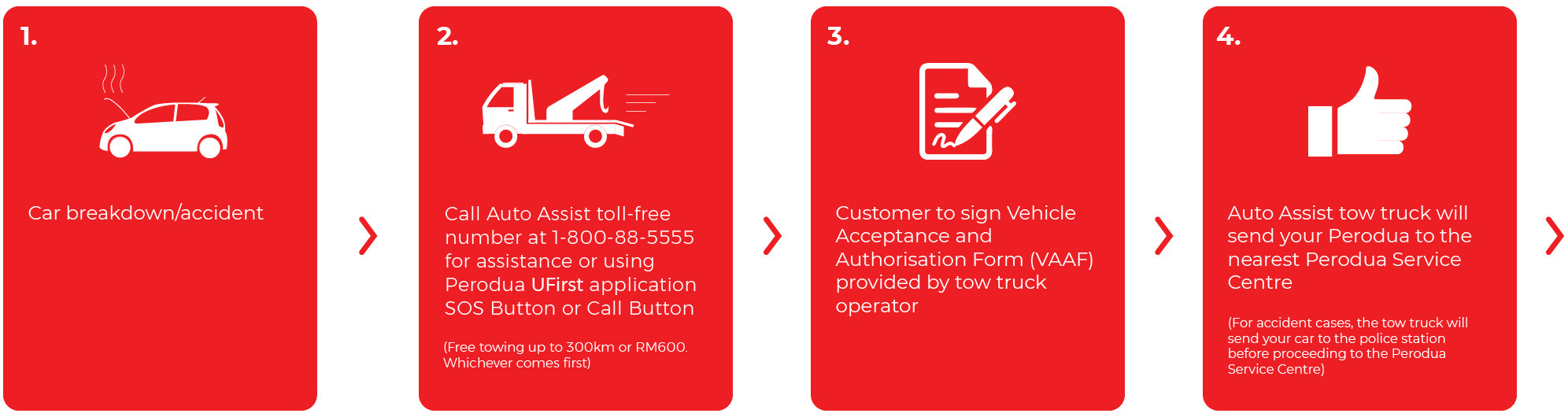

Claim Process

Accident

Perodua total protect plus faq

What is Perodua Total Protect Plus (PTP Plus)?

It is a total insurance protection programme exclusively for Perodua cars. With our comprehensive benefits, we ensure optimum convenience and peace of mind for Perodua owners.

What is the difference between Perodua Total Protect Plus and Perodua Total Protect?

Perodua Total Protect Plus is the improved programme of Perodua Total Protect introducing three additional products: Unlimited Unnamed Driver, Flood Allowance of RM1,000, and Personal Accident worth RM10,000. You can enjoy these additions together with the existing 12 years coverage (Agreed Value, Betterment, Waver of Excess) and Auto Assist coverage.

Are there any changes or additional costs to the insurance premium price on Perodua Total Protect Plus compared to previous programme?

All insurance premium pricing for each customer is determined by the individual insurance companies and their risk factor mechanism for customer profiles.

How to get the new Perodua Total Protect Plus benefits?

Simply insure your Perodua or renew your Perodua car insurance at any Perodua authorised showroom with Perodua insurance panel.

Is this insurance programme available to cars made by different brands?

No, Perodua Total Protect Plus is only applicable exclusively to car models manufactured by Perodua available at Perodua authorised showrooms and selected service centres (3S) with Perodua insurance panel only.

I just got to know about this new Perodua Total Protect Plus programme. However, I already renewed my car insurance elsewhere. Can I cancel my current policy and renew it with Perodua Total Protect Plus?

Yes, you may cancel the policy with the respective insurance company. However, the insurance premium refund will be based on the insurance company’s customary short rates. Otherwise, you may wait until your current policy expires and renew your Perodua insurance with Perodua Total Protect Plus.

What do Unlimited Unnamed Driver, Flood Allowance of RM1,000 and Personal Accident worth RM10,000 entail?

Unlimited Unnamed Driver – There will be no additional RM10 fee for 3rd named driver and above. In the event of an accident, if the named driver is not included in the policy, insurance company will waive RM400 excess charge during insurance claim (This is not applicable if the driver is under 21 years old, holds a Provisional (P) or Learner (L) driver’s licence).

Flood Allowance of RM1,000 – Insured member will be given a lump sum of RM1,000 for any flood related accidents.

Personal Accident worth RM10,000 – Covers cases when the insured vehicle gets involved in an accident whilst driving it or riding in it as a passenger, as well as boarding or alighting from the vehicle.

How can a member make a claim for any of these three (3) benefits?

The vehicle should be repaired, cleaned up, or towed to any Authorised Perodua Service Centre only, with a receipt/invoice. Member may submit all relevant documents to Perodua outlets, or they may directly submit a claim to their respective insurance company with supporting documents as follows:

· Flood Allowance – Copy of Police Report, Copy of Vehicle Repair Invoice/Official Receipt, Photograph before cleaning works and/or any additional documents for verification.

· Personal Accident – Copy of IC, Copy of Vehicle Registration Card, Police Report,Hospital Medical Report.

Perodua total protect plus faq

What should I do if my car breaks down or is involved in an accident?

Call our Auto Assist by Perodua Total Protect Plus toll-free line at 1-800-88-5555 or using Perodua UFirst application SOS Button or Call Button for assistance. Our call centre is available 24 hours a day, 7 days a week, for your convenience.

Who is eligible to be an Auto Assist member?

All new Perodua owners who are insured (a comprehensive motor insurance) with Perodua insurance partners at authorised Perodua showrooms. A member is eligible for one (1) year FREE Auto Assist membership. Members can renew their motor insurance (a comprehensive motor insurance) at any authorised Perodua showroom.

If I renew my vehicle insurance with other than Perodua insurance partners, am I entitled for Auto Assist benefits and coverage?

No. Kindly renew your comprehensive motor insurance at any Perodua authorised showroom to get Auto Assist benefits and coverage for free. Additionally, you will also enjoy other attractive benefits under the Perodua Total Protect Plus Motor Insurance and Auto Assist programme.

How do I subscribe to Auto Assist?

Auto Assist is only available for free with purchase of a new vehicle motor insurance and renewal with Perodua insurance partners at Perodua authorised showrooms.

Are all Perodua vehicles covered by Auto Assist?

Only vehicles registered for private usage are covered by Auto Assist. Vehicles used for commercial purposes (hire and drive, taxi, driving schools, etc.) are not covered.

Do I need to cover any charges when Auto Assist repairs or tows my car?

For minor repairs, the services will be free (such as jump start and punctured tyres). Other charges such as replacement of parts etc. will be chargeable. For breakdown towing, the towing fee is free up to 300KM (roundtrip) or up to RM600, whichever comes first. For accident towing, the towing fee is free up to 100KM or up to RM300.

Do I get free towing services if I decide to pay by cash?

As cash repair insurance does not include the cost for towing services, you will only receive free towing services for up to RM100.

How long can I enjoy the benefits?

You can enjoy the benefits free of charge for the period of 12 months. The coverage of your Auto Assist membership will take effect from the start date of the insurance coverage.

Would the benefits under Auto Assist be extended to any of my family members or friends when they drive my car?

Yes, Auto Assist will still provide the breakdown and towing services to them free of charge, provided the vehicle is registered with Auto Assist. Other benefits will not be extended to any of them.

What if I sell my car?

The benefits and your rights under this plan will cease the moment you sell off your car.

Where can I submit the claims form to enjoy Auto Assist benefits?

Please submit related documents to authorised Perodua showrooms and service centres.

Can I call Auto Assist if my car runs out of fuel?

Auto Assist will provide refuelling services. However, fuel cost is chargeable.

How can I get more information on Perodua Total Protect Plus benefits?

Please call us at 1800-88-6600 (our general line) or visit www.perodua.com.my.

Tempah atau Test Drive Hari Ini...

PHONE

+6013-426 6499

PHONE

+6013-426 6499

junaidialmalizi@gmail.com

ADDRESS

Jln Kamaruddin, Kampung Batu Buruk, 20400 Kuala Terengganu, Terengganu